Sole-Trader & Contractor Tax

All the additional Tax responsibilities that come with being Self-Employed can be pretty overwhelming on top of everything else that’s keeping you busy.

So whether you’re a Contractor, Freelancer or an Entrepreneur – ABA are here so you can focus your time and energy where it matters most.

How can we help You

- Bookkeeping

- BAS & IAS Payroll & Superannuation

- Payroll & Superannuation

- Xero software solutions Cash flow forecasts and budgets

- Cash flow forecasts and budgets

- Coaching and mentoring

Here's what you'll get

- Maximum profits for minimum tax - guaranteed

- Quick and painless Tax Return prep and lodgment

- Your BAS, PAYG and Super prepared

- Expert advice - all year round

- Less paperwork

- More time & energy to focus on what you do best

We take the hassle out of tax time.

We are;

- Sensitive to the needs of Sole-Traders

- Experts in Cloud-based software solutions

- Always available for a chat - even if you just need some advice

Why choose us

We will;

- Prepare Business Schedules & Tax Returns for Sole-Traders

- Assist with Tax Management and planning

- Organise your BAS, PAYG Instalments & Super Obligations

- Reconcile GST and prepare any BAS amendments

Bookkeeping, BAS & Payroll

Strategic Planning

Business Planning

Administration Systems

Bookkeeping, BAS & Payroll

Let’s face it, bookkeeping is an important part of any business but in reality, this process is often neglected. In fact, according to CPA Australia, a large percentage of small businesses fail due to financial mismanagement and weak accounting records.

Inaccurate bookkeeping provides little insight as to your business health and forms the basis of many poor business decisions. Just because you’re busy doesn’t mean you’re profitable, or cash flow positive!

Poor cash flow is generally a symptom of many other underlying problems which can be identified and corrected with sound bookkeeping practices. Current information about where your making money, where your losing money and regulatory obligations is vital to the longevity of your business.

With the assistance of Cloud Software solutions like Xero, we can quickly and cost effectively manage the ‘paperwork’ for you. This lets you concentrate on jobs, customers and daily operations.

From quotes to invoicing, payroll, purchasing and superannuation obligations, we can tailor solutions to meet your individual and business needs. We also ensure accounting compliance and regulatory requirements are met and maintained.

- General Bookkeeping; Data Entry & Reconciliations

- Payroll & Superannuation

- BAS & IAS Preparation & Lodgment

- Comprehensive Reports

- Depreciation Schedules & Asset Register Maintenance

- Business Systems & Procedures

- Migration to Cloud Based Accounting Software (like Xero)

- General Bookkeeping & Software Training

Why Outsource?

- Save Money. It’s no surprise that outsourcing work saves you money. By outsourcing your bookkeeping you eliminate full time staff for part time tasks.

- Save Time. When you outsource your bookkeeping and accounting functions to a skilled team dedicated to tuning your financials into shape, you can focus on what you do the best – developing the business you really want.

- Improve Cash Flow. Being able to access transparent and accurate financial records in real-time means that you can see where you are, problem solve a lack of sales, and confidently plan for the future.

- Expert Services. Outsourcing to a professional bookkeeper ensures that your accounts are managed by someone with the skills to do the job accurately and efficiently. You also gain access to current information on applicable regulatory requirements and obligations to ensure your business stays compliant.

Financial Forecasts & Coaching

Advisory has long been a buzzword in the accounting profession and industry at large. With so many qualified accountants taking the leap into this world, it can be an overwhelming subject to even consider – and also really expensive… But it doesn’t need to be.

In fact, we’re on a crusade to demystify advisory and coaching services for small business owners through innovative software solutions like Futrli.

No one likes spreadsheets, and keeping your forecasting and reporting up to date can be a challenge.

Futrli solves this issue by linking with your Xero, MYOB or QuickBooks file to stream real data which is perfect from both forecasting and to set, monitor and manage a huge range of KPI’s.

Combine monthly or quarterly consults with our one of our very business coaches to really get behind the numbers. Our coaches ask questions about what you want to achieve, examine previous trends and set up forecasts to help you achieve your goals – whatever they may be!

Cashflow forecasting

Unlimited 3-way forecasting up to 10 years in the future shows you what lies ahead for your business. Get full control of your business by monitoring cashflow daily, weekly or monthly, and use your projections to move forward confidently.

Business planning

Project the future of your business with unlimited forecast items. Import existing budgets from spreadsheets to customise your planning, or build quickly from your historical business data. Business planning and achieving your set goals just got easier.

Business budgeting

Live budgeting is the best way to keep your business on track. We make it easy to create a 3-way budget, from your P&L, balance sheet and cashflow statement, for full visualisation of your business. And it’s fully flexible and customisable.

KPI dashboards

See a live view of your business with KPI dashboards. The more data you can get into Futrli, the better, so monitor financial and non-financial metrics in one place. See a beautiful representation of your business you can control.

Business reporting

Report on the financial and non-financial data that makes your business tick. Use templates or build your own custom reports, and add KPIs and formulas to see what you need to see. Export to printable PDFs for a snapshot or client takeaway.

Cloud Software Solutions

Cloud software solutions are the next generation of business functionality and Xero is leading the way.

Cloud software solutions are the next generation of business functionality and Xero is leading the way.

ABA have partnered with Xero to deliver outstanding Cloud Software Solutions to our clients. If you want your business to work smarter and faster, cloud accounting software is a wise investment. Working in the cloud will give you better insight into your finances, and improve collaboration with your team.

You can use cloud-based software from any device with an internet connection. Online accounting means small business owners stay connected to their data and their accountants. The software can integrate with a whole ecosystem of add-ons. It’s scalable, cost-effective and easy-to-use.

In the cloud, there’s no need to install and run applications over a desktop computer. Instead, you pay for the software by monthly subscription. Upfront business costs are reduced. Version upgrades, maintenance, system administration costs and server failures are no longer issues.

Discover for yourself why Xero is one of the most powerful bookkeeping and accounting tools available!

- A custom dashboard lets you see all your bank balances, invoices, bills and expense claims at a glance.

- Interactive graphs show money going in & out, and the watchlist lets you monitor specific accounts.

- Manage your cashflow by scheduling payments and batch paying suppliers.

- Automatic bank feeds provide live data so you can manage cash flow in real-time.

- The ability to collaborate with your team live enables accurate and confident decision making.

- More about XERO

- More about Cloud Accounting Advantages

- Xero Pricing

COMMONLY ASKED QUESTIONS

SaveSaveSaveSave

Strategic planning

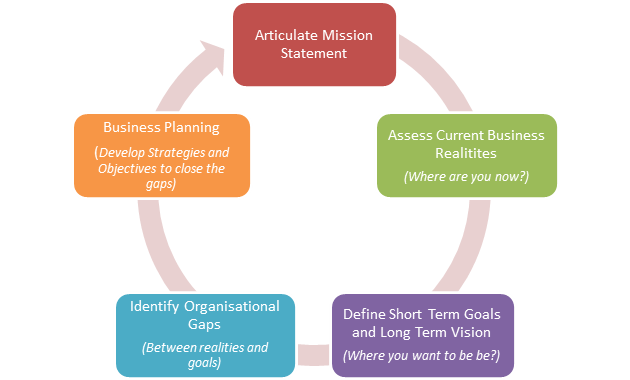

Strategic planning is critical to business success. Different from traditional business planning, the strategic variety involves vision, mission and outside-of-the-box thinking.

The strategic planning process provides an opportunity for your business to assess its current operations, identify weakness and explore future possibilities. Knowing “where you are” enables an accurate benchmark in which to monitor progress.

A Strategic plan describes “where you want your company to go“, not necessarily how you’re going to get there. That is, it holistically defines where your should be positioned in tomorrows market place. It looks outside of daily operations to question best practice, assess competition and drive innovation. It affords management the opportunity to identify results amiss with organisational objectives and quickly intervene with appropriate resources.

Whilst strategy is the heart of business success it need not be a daunting process.

Using the latest mind mapping software, ABA works with you to visually define, design and review your organisational strategy. We start by examining strengths, weaknesses, opportunities and threats. We look for resources and capabilities to leverage for maximum gain, and in-turn we work with you to develop and implement sustainable competitive advantage.

Quite simply, we specialise in Strategic Plans that work!

Why is Strategy so important?

Identified gaps in the Strategic Plan drive the Business Planning process to align operations. Resulting action plans then filter down through the organisation to achieve organisational goals and objectives (Read More)

Strategic Planning In Mind Map Format

Mind mapping techniques are more productive. Defined tasks are layered within your organisation turning ideas into actions much faster than traditional reporting methods. (Read More)

- Visualise ideas and concepts

- Turn brainstorming sessions into action plans

- Run strategy meetings more effectively

- Create work breakdown structures, Gantt chart and timelines

- Collaborate better with team member and clients

- Deliver interactive reports, strategies and marketing plans

- Link KPI’s to strategy

- Easily monitor performance

SaveSaveSaveSave

Business planning

A Business Plan is an essential road map to achieving your organisational goals and objectives. One of the greatest benefits of developing a business plan is that it helps you to focus your resources and plan for business growth.

The business planning process helps you to understand the different factors that may affect your success. Instead of worrying about the future, you can actually have a sense of control over your business and livelihood.

A Business Plan does this by setting milestones and controlling resources. A good business plan should also concentrate marketing efforts, motivate your team and manage performance. It defines “how” you intend to deliver upon your strategic plan.

A Business plan is not a document you create once and store in your bottom drawer. It’s a living guide that you should develop as your business grows and changes.

A good Business Plan should not be encumbered with hundreds of pages scripting irrelevant fluff about non-applicable business practices. Accordingly, we do not use templates or attempt to squeeze your business into a one-size fits all planning model. Instead, we work with you to understand your business, the obstacles and the opportunities, so together we can develop efficient and effective plans to achieve your organisation objectives.

Quite simply, we specialise in Business Plans that work!

- Planning

- Monitoring

- Review

Administration Systems

We are small business professionals with extensive hands-on experience in administration systems that work. We have earnt a solid reputation for designing and implementing user friendly processes to improve efficiency, profitability and cash flow.

Before developing any system we identify administrative requirements in accordance with your organisational budgets and objectives. That is, we want to know the purpose of the activities undertaken and what controls are currently in place. We then work with you to design the most appropriate procedures and policies to govern your business operations.

A good Administrative System will comprise of efficient, goal oriented controls designed to either detect, protect or correct organisational threats. Our goal is to identify internal risk and strengthen key areas to improve the overall health of your business.

- Payroll. Ensure compliance with compulsory employer obligations.

- Accounts Payable. Improve cash flow management and buying decisions.

- Accounts Receivable. Reduce turnaround times and increase cash flow.

- Purchasing. Ensure proper authorisation, allocation and cost control.

- Inventory. Control stock levels, reduce obsolesce and increase buying power.

- Asset Management. Control tools and stock distribution to staff.

- Time-sheets. Control hourly labour expenses & improve customer satisfaction.

Need More Info?

Our goal is to simplify your life when it comes to taxes.

Services

Find what you are looking for on our services page. Individuals, Sole-Traders, Small Business, Property Investment, SMSF's & Late Lodgments. No matter your tax needs, ABA Tax has you covered!

F.A.Q's

Browse through our answers to the most frequently asked questions by our clients about personal income, small business tax and other topics.

Tax Tools

Check out our downloadable checklists, logbooks and calculators to help you manage expense claims, work uniform expenses, car logbooks, rental schedules and more.